|

|

|

|

Saturday, March 29, 2008

It's time to have that talk

"You have the same deterioration of credit standards, the same securitization of debt, the same leveraging, the same inability of people to pay. People are using credit cards as their cushion. We're set up for a consumer credit-card debt crisis if we do nothing." -- Austan Goolsbee, Obama Chief Economic Advisor The man, who shot to fame as the Obama insider who described his campaign's NAFTA stance as politicking rhetoric, is really on to something. With all this talk of sub-prime mortgages, debt of all kinds is finally emerging as a relevant economic issue. As much as it has always been present in discourse, there really has been no sense of urgency as it truly has become a part of our culture. As analysts, journalists and pundits alike, stress about the mistake made by granting such high risk loans to homeowners, I wonder why the issue of the credit card debt hasn't become a more prevalent concern. Considering, a credit card is granted far more indiscriminantly than a mortgage and the interest rate charged is significantly higher. The Federal Reserve says Americans have built almost $1 trillion in "revolving credit." A customer known as a "revolver" is an individual that holds debt and doesn't pay it off each month. Edward Yingling, President of the American Bankers' Association, has referred to this as the "sweet spot" of the industry. The habit of recklessly spending without being in touch if it can be afforded has quickly become a part of our culture in our ever-so materialistic society. Perhaps holding a postive correlation to the credit card companys' voracious marketing campaigns. Every individuals seemingly is inundated with material enticing them to get a new credit card. Zero percent for the first 6 months? Sound familiar? It goes on and on. The key is seeing what comes after these low introductory rates. Andrew Kahr, a credit card industry consultant, credited with introducing the 0% introductory rate and a lower minimum monthly payment, acknowledges that his reasoning for suggesting both these ideas to his client was to allow the customers to be able to take on more debt. Before his idea, credit card companies expected 5% of the principal owed to them paid back to them each year. He recommended that be cut to 2%. If the client just pays their minimum monthly payment each month, it'll take them years upon years to pay off. What has been made clear by experts is that the true success of credit card companies comes in their ability to maintain their debt, which inflicts heavy interest charges. Shockingly (or rather, not so shockingly), twenty-eight percent of Canadians don't even know what interest rate they are paying on their credit cards. Folks, make sure you know.

Monday, March 17, 2008

Shaky Ground

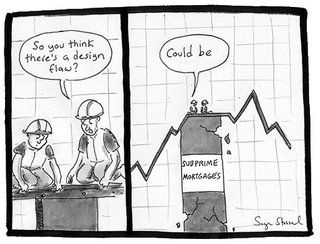

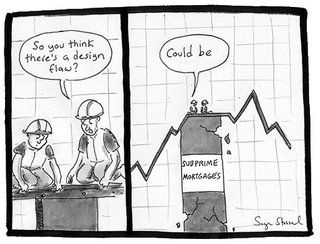

Shaky Ground Shaky GroundCartoon by Sage Stossel of The Atlantic Monthly (www.theatlantic.com)

Friday, March 14, 2008

Death of a Legacy...

Jim Cramer, Eliot Spitzer and Slate.com's Cliff Sloan [Classmates at Harvard Law School] From one of my oldest friends....this picture, and the line, "Simpler Times." The e-mail that was there to greet me when I opened my inbox this afternoon didn't exactly get me thinking of the Spitzer scandal. The scandal had been dominating my free thoughts for the last few days. As news of Eliot Spitzer's penchant for prostitutes broke, my response was absolute disbelief. The man, whose political career was based on ethics and morals, was a genuine do-gooder. Genuinely, he wanted to make a difference. I will say that now, as pundits and rivals say otherwise. They say he was arrogant. They say he was reckless. They say he destroyed reputations. Yes, hard to deny, they say he is a hypocrite. Now that they have opportunity, they've been saying a lot of things. Most significantly as they say his crusade was for political gain, I say his moves against the Wall Street establishment were taken at great risk with no guarantee of anything. This is best exemplified when, in 2002, he made a case to go after the conflict of interest in investment banking research, his press conference regarding Merrill Lynch was unable to find no public officials willing to show their faces. Wall Street held power...most directly in campaign contributions...more indirectly in other ways. Yet, he pressed on. His two-term role as attorney-general of New York brought much success to cleaning up white-collar crime on Wall Street, dealing with issues that had been ignored for years [I debated going into details, but I realize the typical blog reader doesn't have the patience...do the reading...it's been documented]. Briefly, he took on issues, such at excessive executive compensation, market timing and conflicts of interest in investment banking research, which the New York Attorney General's Office had never touched. These responsibilities were left [or, for that matter, not left] to federal jurisdiction. A single man working in an unproven office hardly guaranteed political gain. As there was no precedent for his actions, the chances of falling were quite likely. After everything is said and done, he won't be remembered for successes as Attorney General, nor for his call to reform in the Governor's office, which may or may not have been a success. The sad thing is we will never know. Not to justify his actions for they are unjustifiable. I wonder, though, if it was anybody else............. Canada needs an Eliot Spitzer.

Friday, March 7, 2008

'Obama' Consulting Group?

"I'm asking you to believe. Not just in my ability to bring about real change in Washington...I'm asking you to believe in yours." -- Barack Obama Although this entry isn't to be taken as an endorsement of Senator Barack Obama, I am very much in love with the way he has conducted his campaign. His process-oriented approach has focussed on the way politics is being done in Washington. Yes, he speaks of policy, and he has a solid stance on the issues. However, it's not the issues that have gotten people in the very grass-roots level involved. Potential voters, in the past, that have been apathetic are being made passionate. Amazing, really. Due in large part to this, I've taken a great deal of inspiration watching this political figure run his campaign. Why? I feel this boutique consulting firm [Onus] is taking baby steps to doing just that by 'campaigning' the way business is done in the retail investment industry. By staying away from the actual investment advice side of the business and focussing directly on the client-broker relationship (at times, for example, a buy-at-all costs approach), it's possible to get people involved and conscious at the grassroots level. Embedded fees? Fee-based vs. commission-based? Advisor accountability? Extra! Extra! Read all about it....This consciousness is improving the quality of financial advice without actually giving any. The more a client knows entering a relationship, the healthier that relationship will be. The success of Obama reminds me that this attitude can make a difference. To have a voice to aid bringing transparency to the retail investment industry (leaving the investing to the brokerages) and examing the client-broker relationship....Can we help in being successful? Can we help in bringing about real change in Bay Street's retail investment industry? Time will only tell. Even Obama has a long way to go.

Momentum everywhere

Watching the battle for the democratic nomination in the United States unfold, one can't help but be captivated. The 'process-oriented' approach of Barack Obama vs. the 'tested and true' policy approach of Hillary Clinton is incredibly compelling. Watching the shifts in momentum as the campaigns progress, I can't help but be reminded of this market volatility that we're experiencing. In the beginning, it was Clinton as the odds-on favorite. Then, Obama won Iowa, and then the momentum shifted in his favour capped by 11 straight wins. This all changed this past Tuesday when Clinton snapped back with wins in Ohio, Rhode Island and Texas. With a great chance of capturing the superdelegates due to the deep Clintonian roots within the party, it's back to Clinton. A parallel can be drawn between Clinton and Obama versus the bull and bear markets. Watch the index explode upwards, analysts and economists are speaking of the market's resiliency. A slowdown, sure...but no recession. Watch sharp drops in the index, and we're talking of the disaster of the sub-prime mess and being embroiled in a US recession. Feel free to designate whether you feel Obama or Clinton is the bull, as there will be a loser in this campaign. Regardless, folks, we are in a bear market, which will show resilience and overcome this sub-prime fiasco....and, yes, it is very likely we will see a Clinton-Obama or an Obama-Clinton Democratic ticket (don't ask me which one).

|

|

"You have the same deterioration of credit standards, the same securitization of debt, the same leveraging, the same inability of people to pay. People are using credit cards as their cushion. We're set up for a consumer credit-card debt crisis if we do nothing."

"You have the same deterioration of credit standards, the same securitization of debt, the same leveraging, the same inability of people to pay. People are using credit cards as their cushion. We're set up for a consumer credit-card debt crisis if we do nothing."